Those that have been around here the longest know for a fact that I love to wallow in the really scary, bad stuff.

Consistently the scariest of the scary guys I like to read is Martin Weiss at

at  Money and Markets.

Money and Markets.

I used to call him "The Angel of Death" and everybody at my office would know exactly who I was referencing.

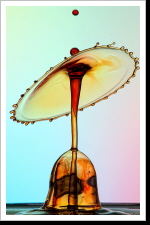

Here's a simple chart and some analysis from Mr. Weiss concerning our ongoing adventure in debt.

Not for the faint of heart.

As always click on the chart in order to link up with the entire piece.

Lie #3. They insist that America’s largest banks are safe.

The truth: The largest U.S. banks continue to hold nearly all of the derivatives in the country.

Goldman Sachs has $44.9 trillion in derivatives.

Bank of America has $52.5 trillion.

Citibank has $54.1 trillion.

And JPMorgan Chase towers over all others with $79.5 trillion of these potentially dangerous investments.

In total, JPMorgan, Goldman, Citibank, and the BofA alone are exposed to $234.7 trillion in derivatives. In contrast, among the thousands of other U.S. banks, the grand total of derivatives is a meager $9.3 trillion. In other words, these four banks are exposed to more than 25 times the sum total of all derivatives held by every other bank in the United States.

Never before has so much financial power — and risk — been concentrated in the hands of so few!

Yes, these numbers, reflecting the “notional” value of the financial instruments at play, are far larger than the actual amounts invested. But still, the risks are huge …

- The derivatives held by Bank of America are 36 times larger than TOTAL assets;

- At JPMorgan Chase, they’re 46.1 times larger than the assets;

- At Citibank, 46.6 times larger; and

- At Goldman Sachs Bank, a shocking 533 times larger!

Yes, in recent months, some banks have reduced somewhat their exposure to defaults by their counterparties. But here again, the exposure remains massive: According to the OCC, for each dollar of capital …

- Bank of America has $1.82 in credit exposure to derivatives;

- Citibank also has $1.82;

- JPMorgan Chase has $2.75; and

- Goldman Sachs is, again, at the greatest risk of all — with $7.81 in credit exposure for each dollar of capital.

That means that if JPMorgan’s counterparties defaulted on 36% of their derivatives, every last dime of the company’s capital would be wiped out. And at Goldman Sachs, defaults on just 13% of its derivatives would wipe out its capital.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)