The following is taken from  Zero Hedge.

Zero Hedge.

With apologies to Tyler Durden, I took for all practical purposes the entire post as I couldn't figure a way to abbreviate it and still suck you into clicking through to read it all.

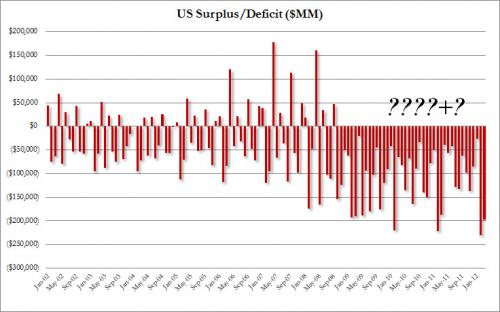

Following the all time record high February budget deficit of $232 billion, the US March budget deficit number is in, and in addition to being bigger than expected, coming at $198.2 billion on expectations of "only" $196 billion, the government outlay in the past month also is the largest March deficit on record.

of $232 billion, the US March budget deficit number is in, and in addition to being bigger than expected, coming at $198.2 billion on expectations of "only" $196 billion, the government outlay in the past month also is the largest March deficit on record.

This brings the total deficit in fiscal 2012 to $779 billion, which is to be expected for a country gripped in total political chaos and which is unable to either raise revenues or lower spending.

What is more disturbing is that over the same period (Oct 1 2011 - March 31, 2012), the US government issued $792 billion in debt, a trend that will continue.

What is most disturbing is that the comparable tax revenues net of refunds, "matching" this increase in deficit and spending, are only $693 billion, in other words the US government is funding well more than half of its cash needs with debt rather than with tax revenue.

The chart below speaks for itself ...

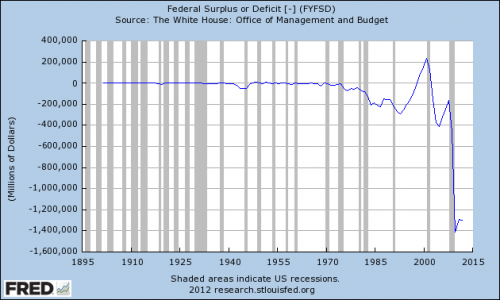

... as does the long term chart.

Now, from Learn Liberty.org who typically do a very nice job of explaining economic issues in terms most civilians can easily understand, a two minute vid boiling the conversation about the deficit down to terms practically anybody can grasp.

who typically do a very nice job of explaining economic issues in terms most civilians can easily understand, a two minute vid boiling the conversation about the deficit down to terms practically anybody can grasp.

Followed by an incomplete (IMHO) conversation having to do with the historical fact that over the past 50 years, massive changes to the tax rate and code have made very little difference in the government's total take as a percentage of GDP.

That which the left seemingly finds impossible to grasp is the notion that people make decisions about work and money and subsequently change their behavior in response to the tax code.

Raising capital gain rates influences some people to hold assets who would otherwise be sellers.

Reduced sales of financial assets yields a reduction in federal tax receipts as assets become locked in place while dampening economic activity as new endeavors find it more difficult to obtain capital.

Raising marginal rates on labor causes some people to work less as work becomes financially less worth the extra effort.

Fewer hours yields lower incomes along with reduced income and payroll taxes.

Which is why lower tax rates and a simplified tax code will always inspires economic growth and subsequently provide enhanced funding for government.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)