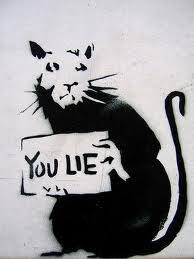

I'd like a Double Irish With A Dutch Sandwich please.

The funniest thing to me about the growing brewhaha over Google and now Apple's perfectly legal (and dare I say it? ... moral) by the letter application of our moronic tax code is the fact that their approach is so well known and by the way so pervasive, that not only does it have a name, "Double Irish With A Dutch Sandwich" it also has a Wikipedia page.

The funniest thing to me about the growing brewhaha over Google and now Apple's perfectly legal (and dare I say it? ... moral) by the letter application of our moronic tax code is the fact that their approach is so well known and by the way so pervasive, that not only does it have a name, "Double Irish With A Dutch Sandwich" it also has a Wikipedia page.

From Wikipedia.

As always click anywhere below for the entire article.

Double Irish arrangement

Overview

Typically, the company arranges for the rights to exploit intellectual property outside the United States to be owned by an offshore company. This is achieved by entering into a cost sharing agreement between the U.S. parent and the offshore company, in the terms of U.S. transfer pricing rules. The offshore company continues to receive all of the profits from exploitation of the rights outside the U.S., without paying U.S. tax on the profits unless and until they are remitted to the U.S.[2]

It is called "The Double Irish" because it requires two Irish companies to complete the structure. The first Irish company is the offshore company which owns the valuable non-U.S. rights. This company is tax resident in a tax haven, such as Bermuda or the Cayman Islands. Irish tax law provides that a company is tax resident where its central management and control is located, not where it is incorporated, so that it is possible for the first Irish company not to be tax resident in Ireland. The first Irish company licenses the rights to a second Irish company, which is tax resident in Ireland, in return for substantial royalties or other fees. The second Irish company receives income from exploitation of the asset in countries outside the U.S., but its taxable profits are low because the royalties or fees paid to the first Irish company are deductible expenses. The remaining profits are taxed at the Irish rate of 12.5%.

For companies whose ultimate ownership is located in the United States, the payments between the two related Irish companies might be non-tax-deferrableand subject to current taxation as Subpart F income under the Internal Revenue Service's Controlled Foreign Corporation regulations if the structure is not set up properly. This is avoided by organizing the second Irish company as a fully owned subsidiary of the first Irish company resident in the tax haven, and then making an entity classification election for the second Irish company to be disregarded as a separate entity from its owner, the first Irish company. The payments between the two Irish companies are then ignored for U.S. tax purposes.[1]

Dutch Sandwich

The addition of a Dutch Sandwich to the Double Irish scheme further reduces tax liabilities. Ireland does not levy withholding tax on certain receipts fromEuropean Union member states. Revenues from income of sales of the products shipped by the second Irish company are first booked by a shell company in the Netherlands, taking advantage of generous tax laws there. Funds needed for production cost incurred in Ireland are transferred there, the remaining profits are transferred to the first Irish company in Bermuda. If the two Irish holding companies are thought of as "bread" and the Netherlands company as "cheese," this scheme is referred to as the "Dutch Sandwich."[3] The Irish authorities never see the full revenues and hence cannot tax them, even at the low Irish corporate tax rates. There are equivalent Luxembourgeois and Swiss sandwiches.

Companies using the arrangement

Major companies known to employ the Double Irish strategy are:

I left the list out just because I wanted you to give Wikipedia a click as I couldn't figure a way to abbreviate this post and still have it make sense.

The moral remains constant.

The lower the rate, the less incentive to create and exploit loopholes in your tax code and more importantly the greater the incentive you create for the rest of the world to bring their taxable income to you.

That's a good thing.

Best of all, the only cost of this approach accrues to your corrupted government types who lose the ability to exchange tax writing favors for political power.

Be still my beating heart.

- Read more about I'd like a Double Irish With A Dutch Sandwich please.

- Log in or register to post comments

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)