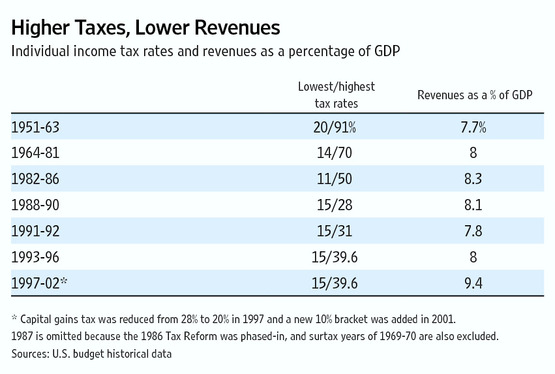

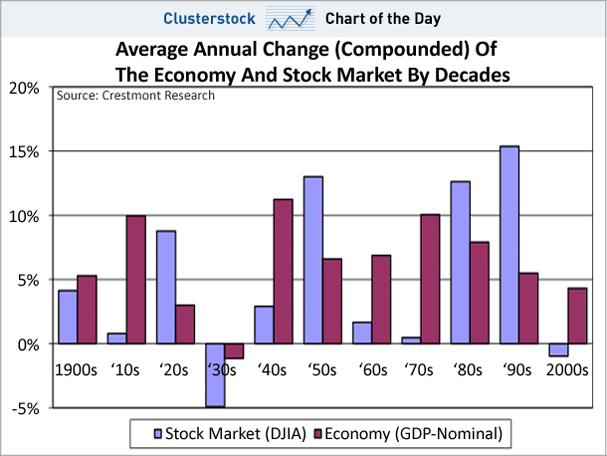

Tax Rates and Receipts

Here's a nice little chart that comes with an editorial from the  Wall Street Journal.

Wall Street Journal.

The chart is so good at making it's point I don't think you necessarily need the editorial, but if you want it you can link it up by clicking on the chart ..... as usual.

This is pure human nature at work here.

If most of your profits are going to go to the government anyway but your losses are your own, why bust your ass, why put your capital at risk, why do anything other than the bare minimum?

If you want some more revenue for public development, your social programs, a couple more wars or straight out vote buying, you are going to have to figure out how to grow the economy.

- Read more about Tax Rates and Receipts

- Log in or register to post comments

.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)