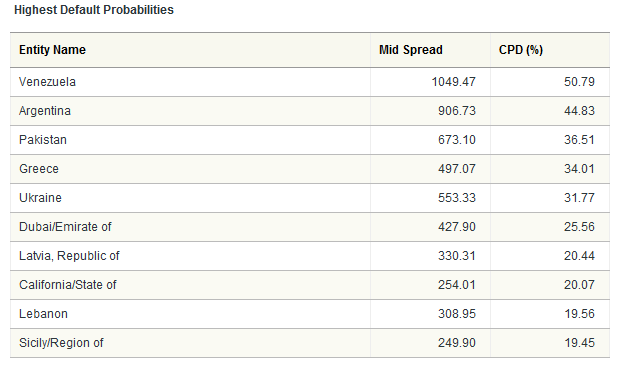

Four different services hit my mailbox last night with the same headline.

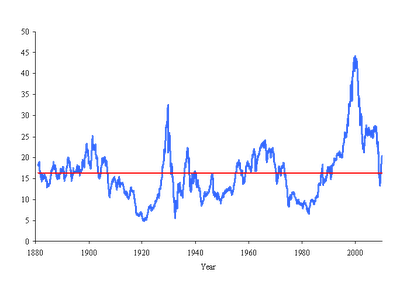

Ten Year Treasury Hits 4%

Putting aside the notion that a 4% yield over the next 10 years lent to anybody (let alone the Federal Government of the United States of America) even approaches a reasonable compensation for risk.

The much referenced "Head and Shoulder" Top is in.

My preference would be for it to go back up and close that gap between about 118.3 and 117.5 and then finish.

As a matter of fact, I believe it will, only because I have come to the conclusion that the notion of randomness in the world is a deception.

I have come to believe that the world is just about as anal and rhythmic as I am (which is pretty damn).

I also believe that the Fed will use every lever to hold rates down.

I'm just not sure it's gonna work.

Savers may not be gasping for income that much longer.

Oh yeah, and P.S.

Did you make that refi application yet?

.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)