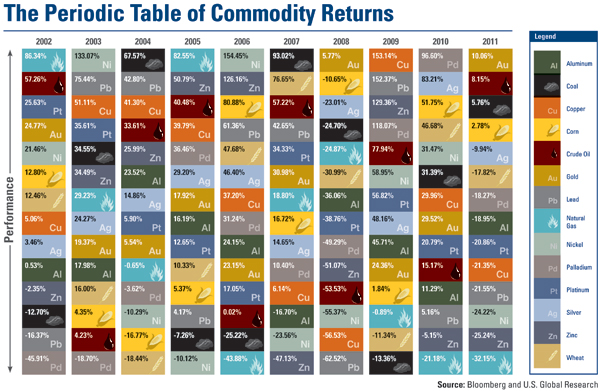

The Periodic Table of Commodity Returns ... not really but so what?

Here's a nicely done graphic from Bloomberg and

and  US Global Funds of the yearly return over the past ten years for many of the most commonly traded commodities.

US Global Funds of the yearly return over the past ten years for many of the most commonly traded commodities.

Click on the table for an enlarged version that you can actually read.

Click the gears above pointing at US Funds for Frank Holmes short, clear and simple piece with some more simple and clear charting from US Gobal Research who would like for you to open an account.

And should you choose to read Mr. Holmes article, do so with the wisdom of Casey Stengel firmly placed in the front of your mind.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)