News of the future ..... today

Coming to a screen near you ..... in both form and content.

Admit it now ... ain't that just a lot better than Lawrence O'Donnell?

- Read more about News of the future ..... today

- Log in or register to post comments

Coming to a screen near you ..... in both form and content.

Admit it now ... ain't that just a lot better than Lawrence O'Donnell?

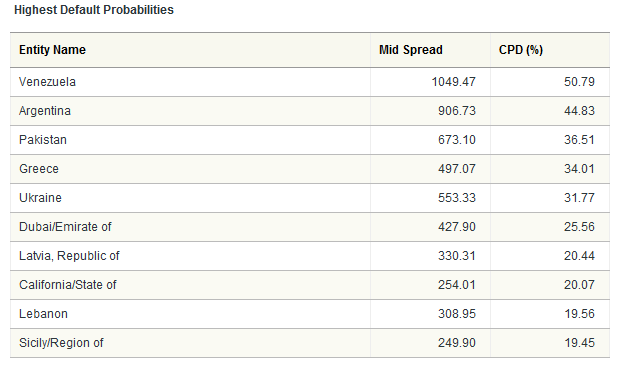

Joining Venezuela, Argentina, and Greece among other notable bastions of fiscal responsibility, California sprints into the top ten list of likely international deadbeats with a very impressive 20% probability of default.

Can Sam be far behind?

Not a chance!!!!!

Owning your own printing press is a good thing ... for everyone but savers.

The Guidotti-Greenspan Rule

Named for Pablo Guidotti, former deputy minister of finance for Argentina (that bastion of resposibility in national financing), and Alan Greenspan, increasingly discredited former chairman of the Federal Reserve Board of the United States (that other bastion of responsibility in national financing)

States that a countries financial reserves should equal short-term external debt (one-year or less maturity), implying a ratio of reserves-to-short term debt of 1.

The rationale here, is that countries should have enough reserves to resist a massive withdrawal of short term foreign capital.

The U.S. holds gold, oil, and foreign currencies in reserve.

The U.S. has 8,133.5 metric tonnes of gold (supposedly, ain't nobody counted it in generations).

It is the world's largest holder (supposedly, ..... ).

That's 16,267,000 pounds (at the risk of redundancy ....... ).

At about $1,100 per oz. or $17,600 per pound, it's worth just under $300 billion (you know ..... ).

The U.S. strategic petroleum reserve shows a current total position of 725 million barrels of oil.

At about $80 per barrel, that's roughly $58 billion.

And according to the IMF, the U.S. has $136 billion in foreign currency reserves.

So altogether... that's around $500 billion of reserves.

Now, consider this .............

Within the next 12 months, the U.S. Treasury will have to refinance $2 trillion in short-term debt.

That's not counting any additional deficit spending, maybe another $1.5 trillion ..... ish.

Add it up and you get $3.5 trillion ..... or so, a trillion here a trillion there, pretty soon you're talking about real money.

That would be about 30% of our entire GDP.

Where do you think that money is gonna come from?

They're gonna print it.

Or snatch your IRA.

If not both.

The above was taken almost in it's entirety (with the exception of the bitter and/or sarcastic comments usually written with type just about this big) from a Porter Stansbury article that was all over the place most of this past fall.

It appears here,![]() here,

here,![]() here

here ![]() and there,

and there,![]() but originated here

but originated here ![]() (somewhere).

(somewhere).

But Portugal, Ireland, Greece, and Spain are hardly worthy of so much attention.

And Ireland? The Emerald Isle has a population similar to Kentucky, at around 4 million.

“My seven states of energy debt represent a full 35% of the total US population.

Washington can print up dollars and fund these states for years, if it so chooses.