Unemployment

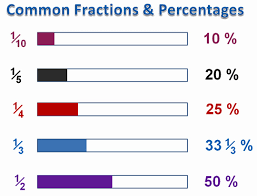

A fraction is made up of 2 numbers. The top number is called the NUMERATOR and the bottom number is called the DENOMINATOR. Inthe fraction ![]() the 3 is the numerator and the 4 is the denominator.

the 3 is the numerator and the 4 is the denominator.

DENOMINATOR: This number shows how many equal 'pieces' something has been divided into. In the fraction, ![]() the denominator is 4 which means there are 4 equal pieces that make up the whole.

the denominator is 4 which means there are 4 equal pieces that make up the whole.

NUMERATOR: This shows how many of those pieces there are. In the fraction ![]() there are 3 out of the total of 4 pieces.

there are 3 out of the total of 4 pieces.

In order to convert a fraction to a percentage, divide the top of the fraction by the bottom, multiply by 100 and add a "%" sign.

So, just for fun, in our example above 3 divided by 4 equals .75. .75 multiplied by 100 equals 75%.

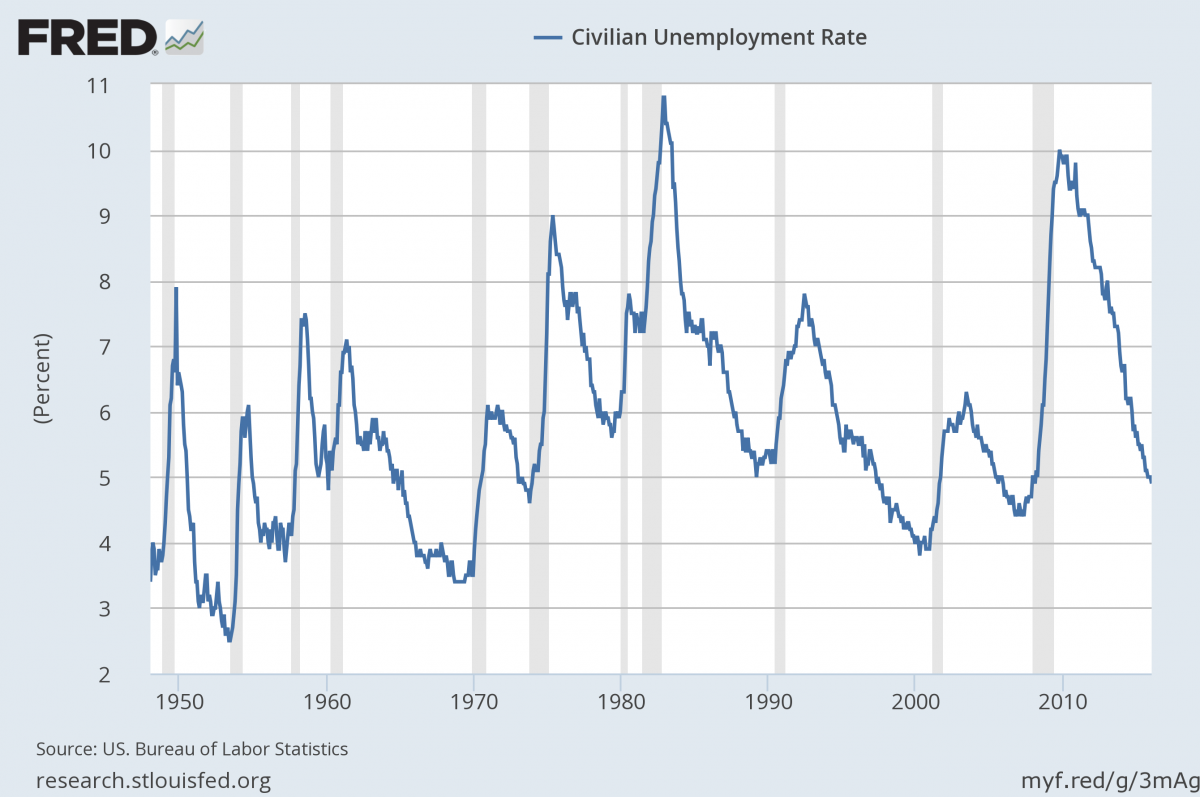

I bring this up as a preface to a discussion of the headline unemployment rate otherwise known as U3 which is presently at 4.9% according to the bureau of labor statistics.

U3 is calculated as follows, unemployment rate = number unemployed / civilian labor force x 100

So, here's an example of a calculation employing the above formula that yields a five percent unemployment rate.

unemployment rate = 5,000,000 / 100,000,000 x 100 = 5 percent

Got it? Of course you do, it's simple. But there is mischief afoot and that mischief is found in the catagory "Civilian Labor Force."

Civilian Labor Force" is defined by the Bureau of labot Statistics for purposes of this calculation as follows: All persons in the civilian noninstitutional population classified as either employed or unemployed.

Employed persons are defined for purposes of this calculation as follows: All persons who, during the reference week (week including the twelfth day of the month), (a) did any work as paid employees, worked in their own business or profession or on their own farm, or worked 15 hours or more as unpaid workers in an enterprise operated by a member of their family, or (b) were not working but who had jobs from which they were temporarily absent. Each employed person is counted only once, even if he or she holds more than one job.

Unemployed persons are defined for purposes of this calculation as follows : All persons who had no employment during the reference week, were available for work, except for temporary illness, and had made specific efforts to find employment some time during the 4 week-period ending with the reference week. Persons who were waiting to be recalled to a job from which they had been laid off need not have been looking for work to be classified as unemployed.

Lets go back up to our example above: unemployment rate = 5,000,000 / 100,000,000 x 100 = 5 percent unemployed.

Only let's suppose that we have only 75,000,000 in "Civilian Labor Force rather than the 100 million in the above example.

The calculation now looks like this, unemployment rate = 5,000,000 / 75,000,000 x 100 = 6.7 percent unemployed.

Let's say we have unly 60 million people in the labor force. The calculation now looks like this, unemployment rate = 5,000,000 / 60,000,000 x 100 = 8.3 percent unemployed.

It's easy to see here how increasing the numerator, in this case the number of people within the "Civilian Labor Force" reduces the unemployment rate without adding a single job.

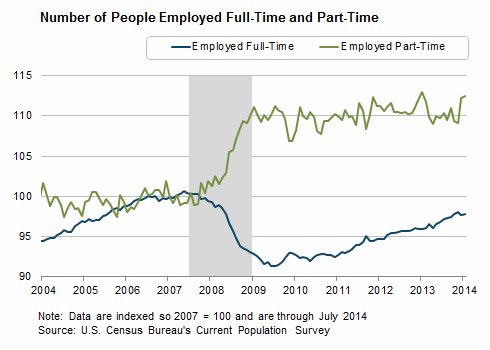

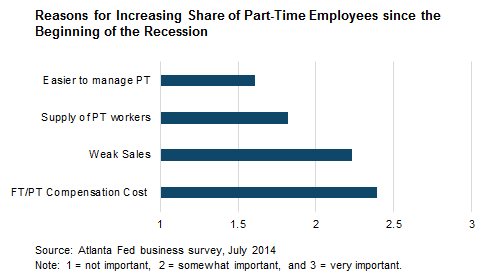

How do you increase the numerator? It's pretty simple really. Let's say an employer decides, for any reason whatsover, that rather than employing one, fulltime, 40 hour a week employee, he would prefer to have two, 20 hour a week, part time employees. Presto, for purposes of this calculation you now have two employed people where before you only had one despite the fact that the total hours worked and subsequently compensated for hasn't change at all.

Lets take a look at the denominator or the number of people unemployed. The definition for "Unemployed Worker" requires that person to have actively looked for a job in the preceeding four weeks. If you stop looking, you no longer count within the calculation.

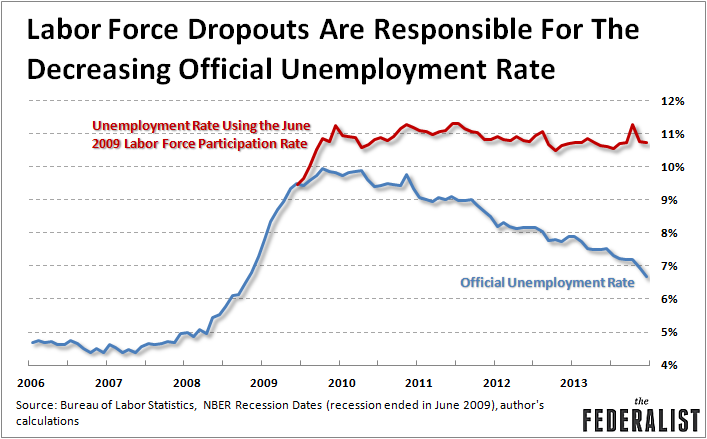

So again using our example above, unemployment rate = 5,000,000 / 100,000,000 x 100 = 5 percent, lets say 1 million unemployed people, for any reason, stopped looking for work last month. they no longer count as unemployed, so the calculation becomes as follows, unemployment rate = 4,000,000 / 99,000,000 x 100 = 4.04 percent.

You have to take that million people who stopped looking for a job from both the numerator and the denominator in order to make the defined calculation, but by virtue of the nature of division, the result is profound. You knock nearly 1% of the unemployment rate.

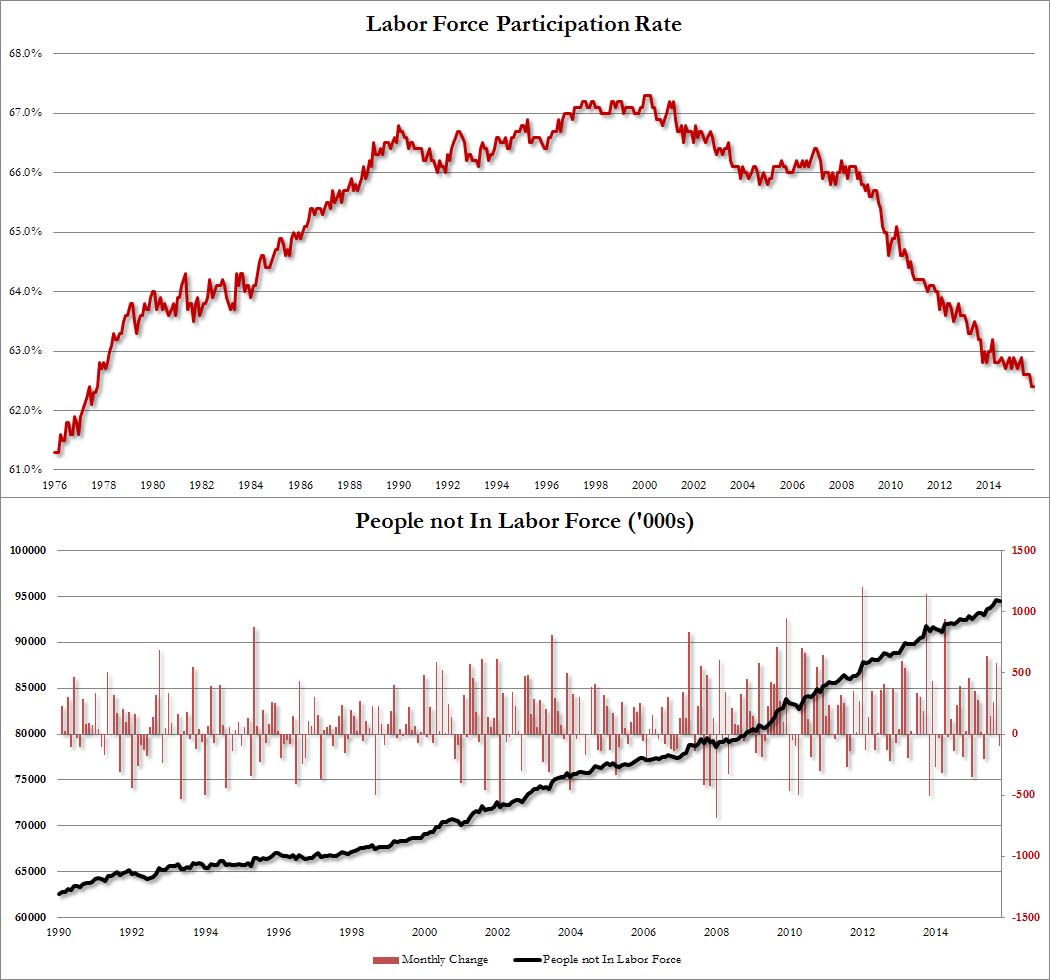

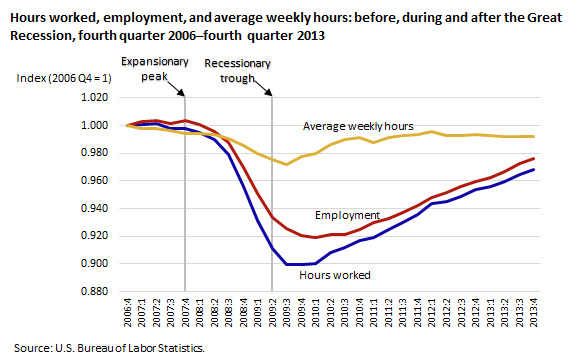

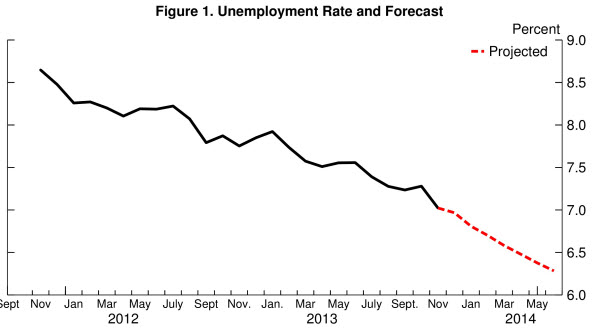

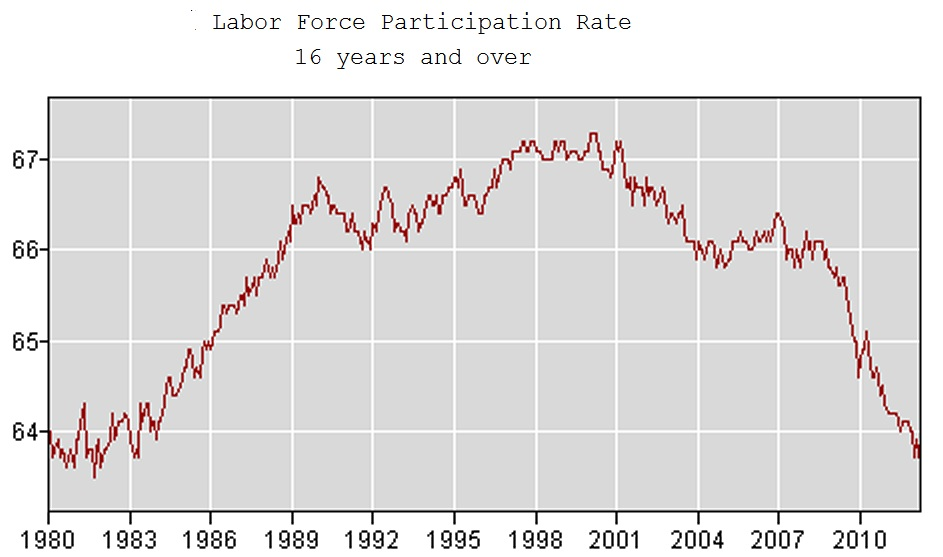

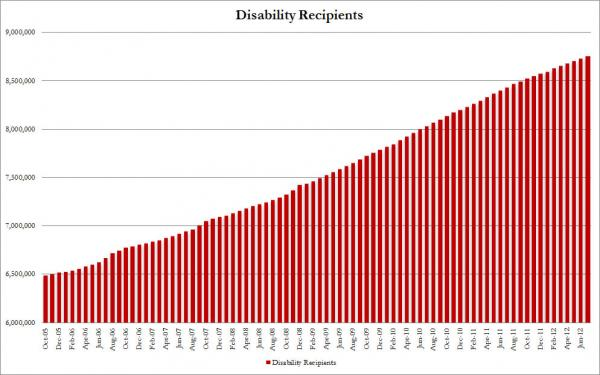

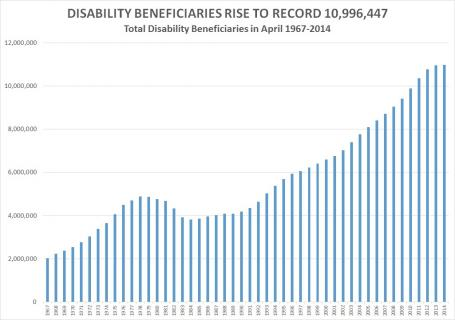

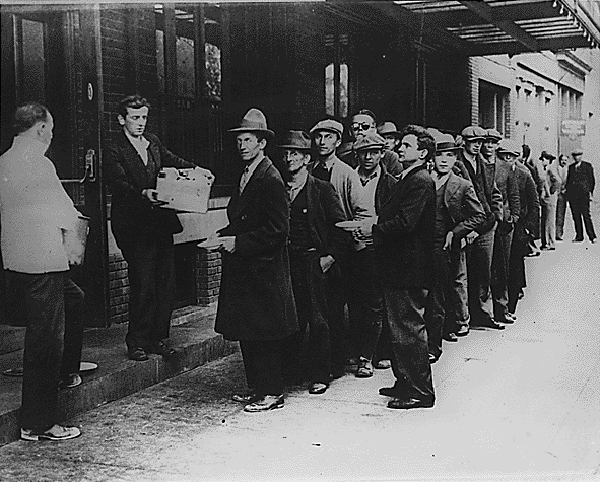

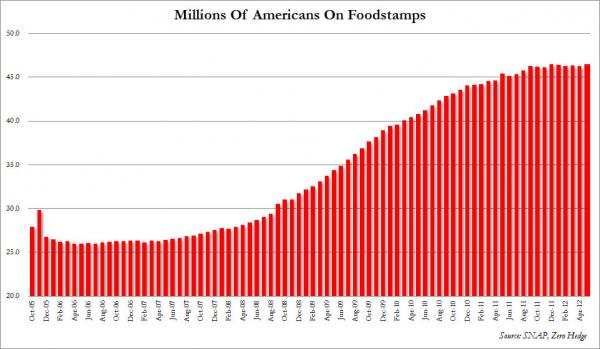

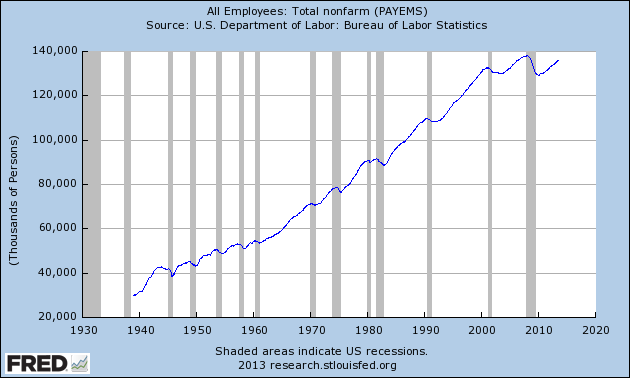

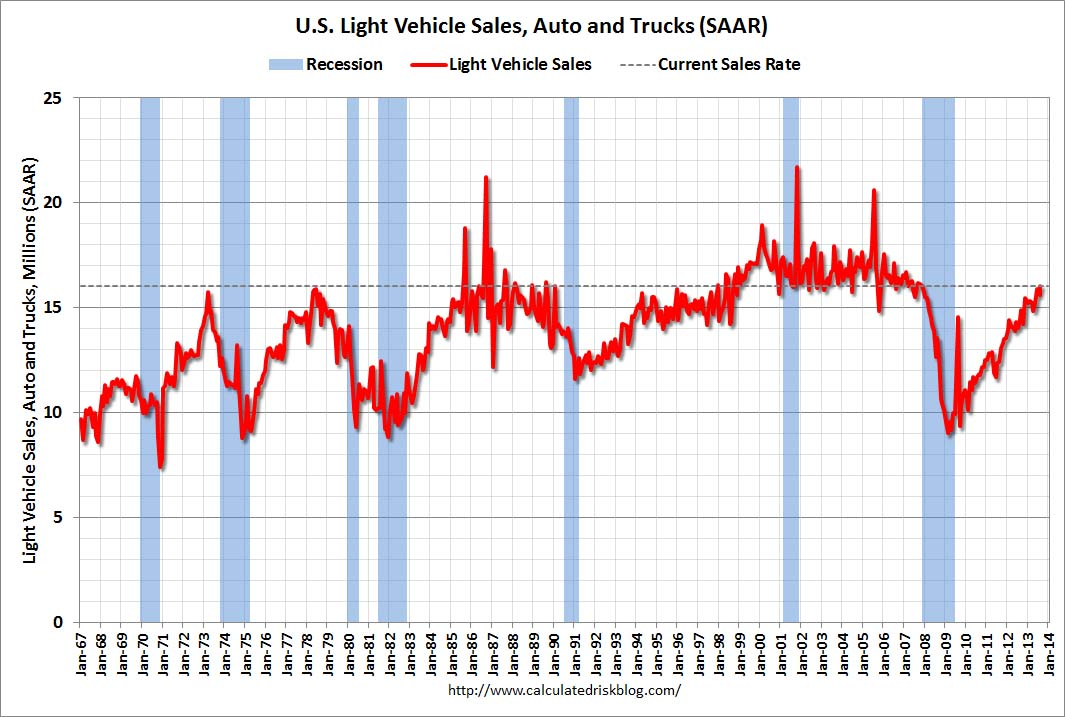

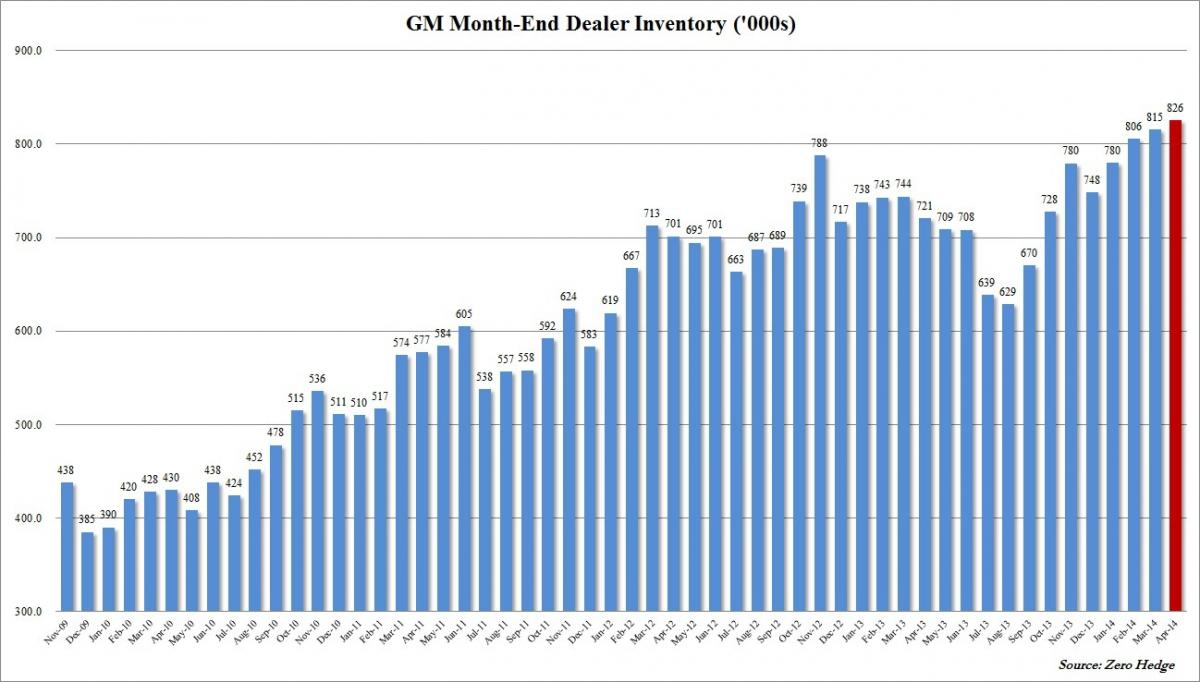

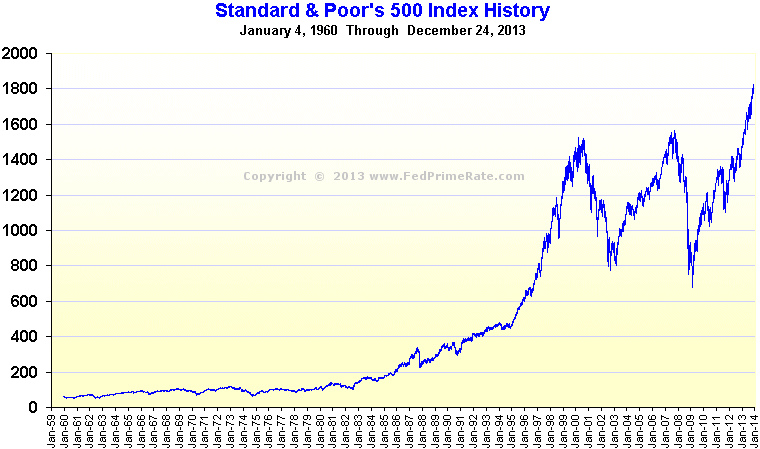

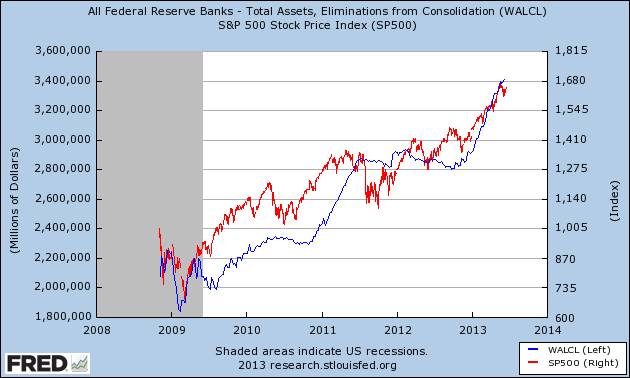

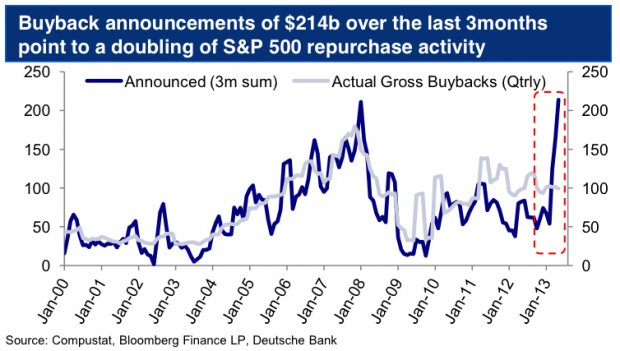

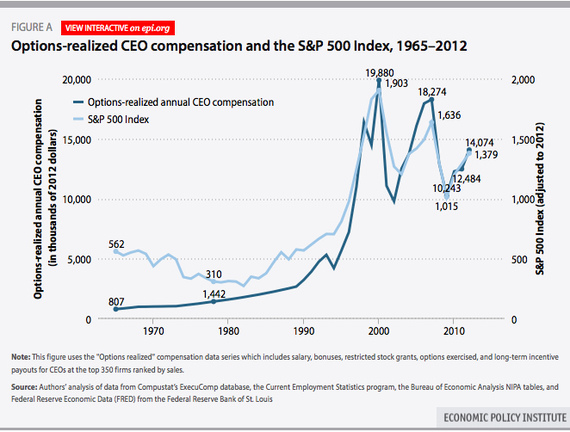

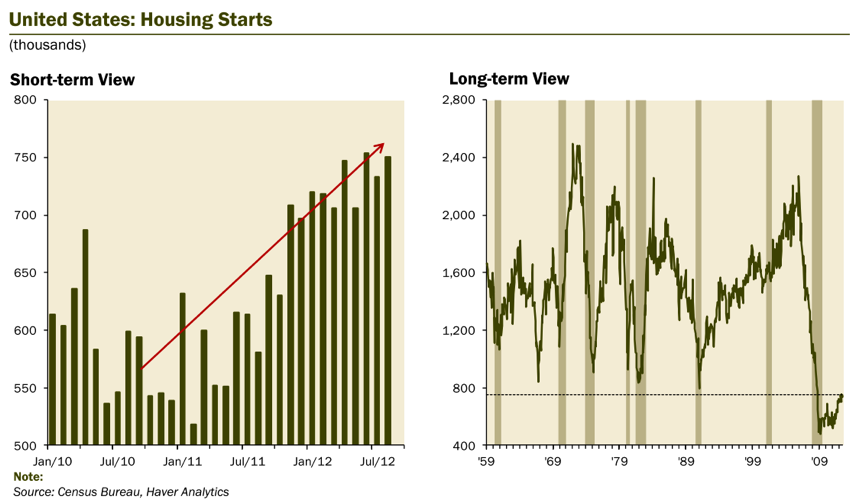

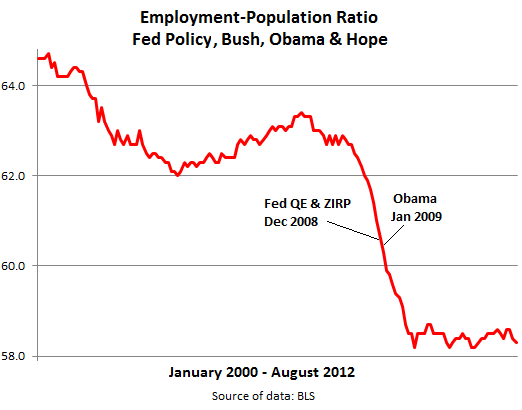

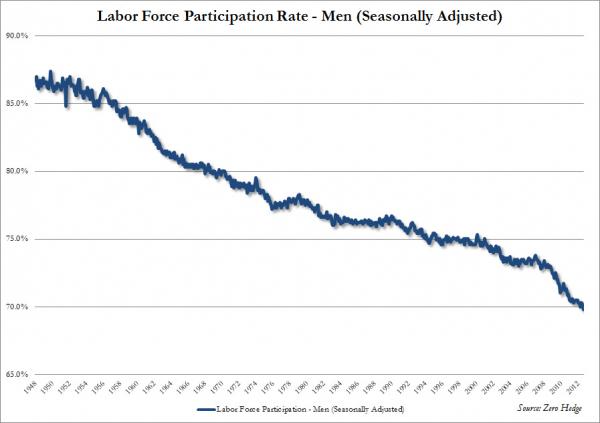

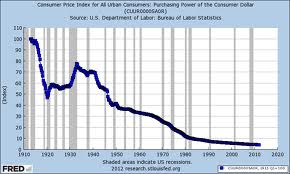

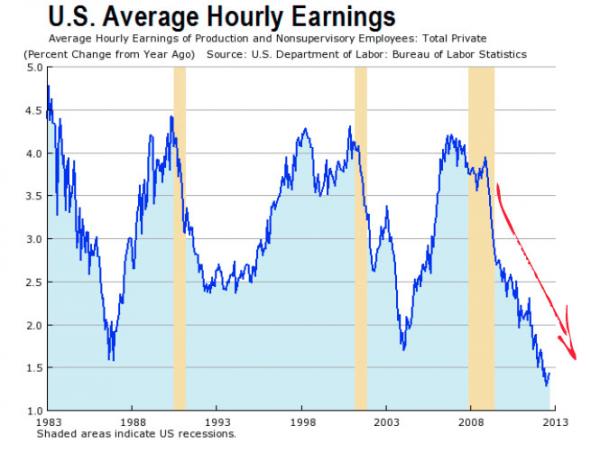

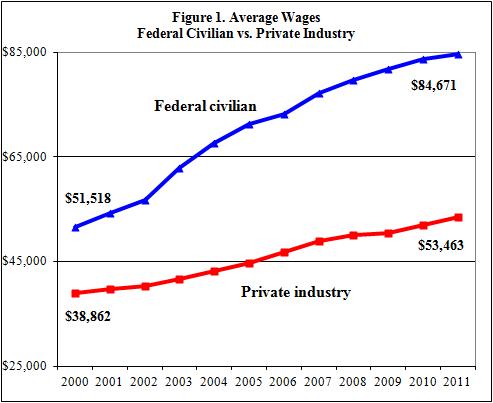

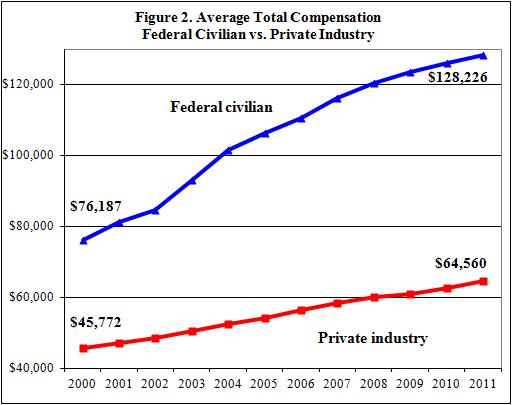

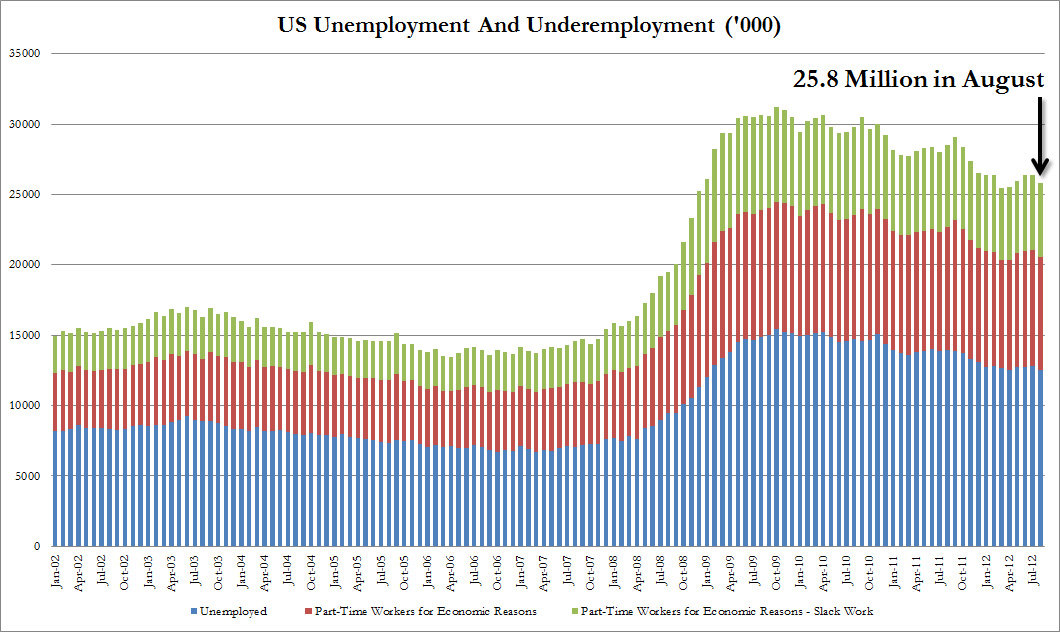

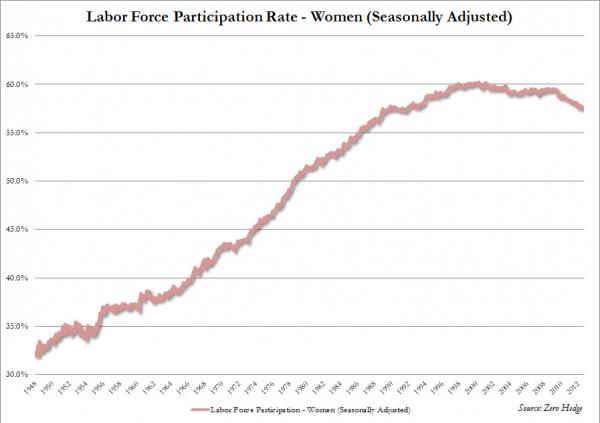

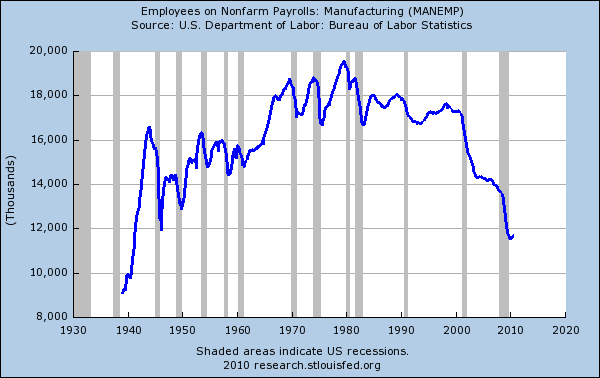

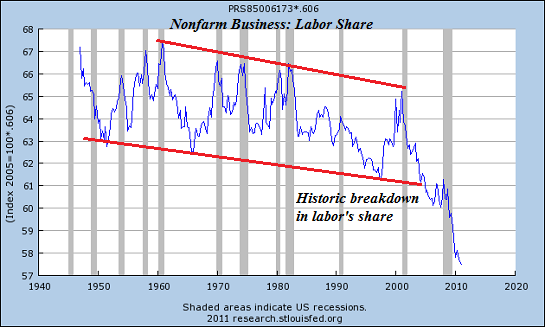

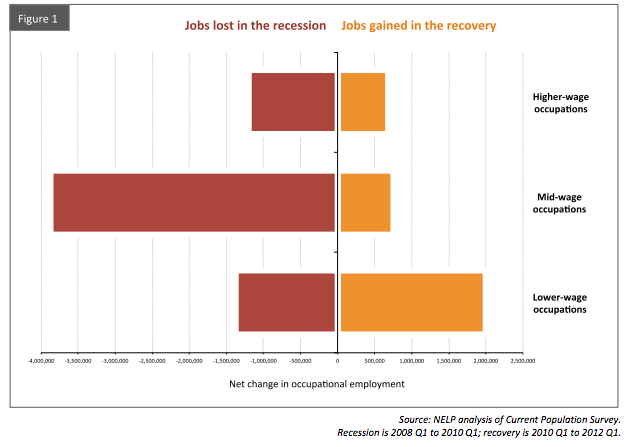

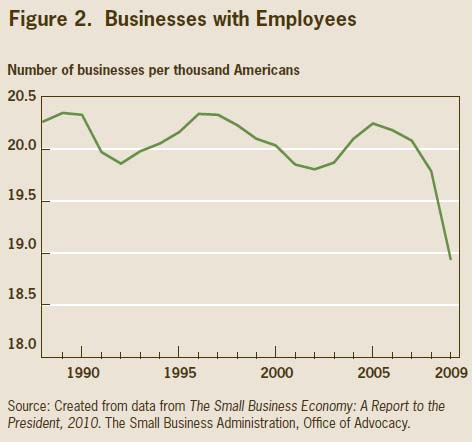

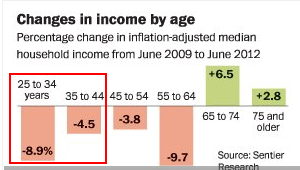

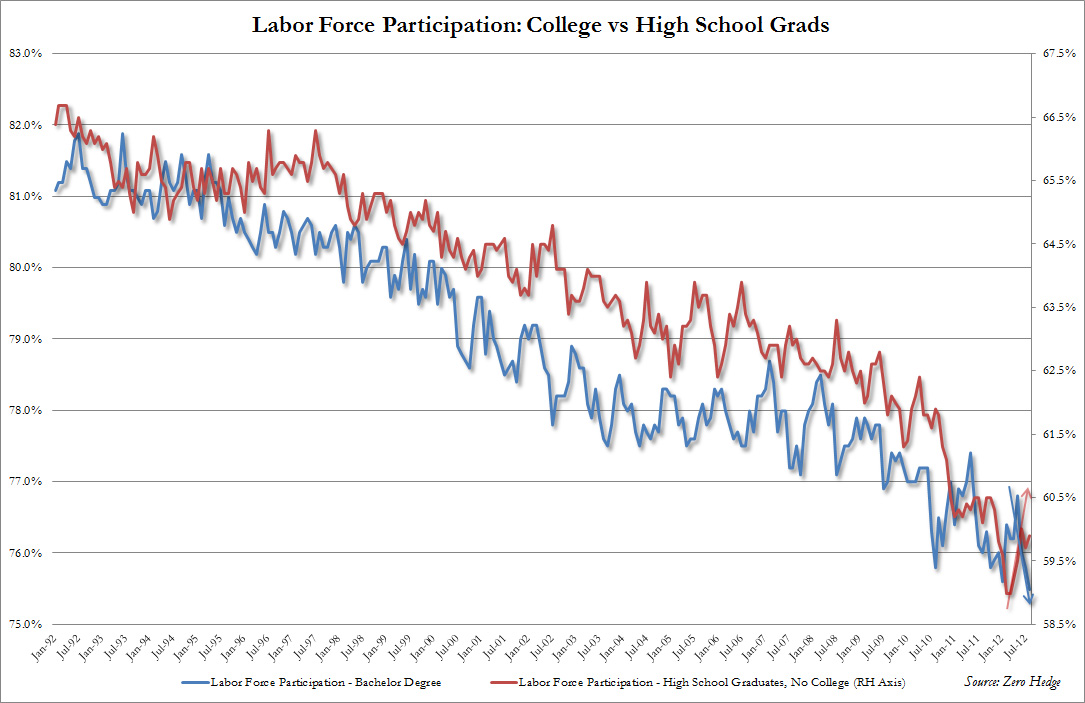

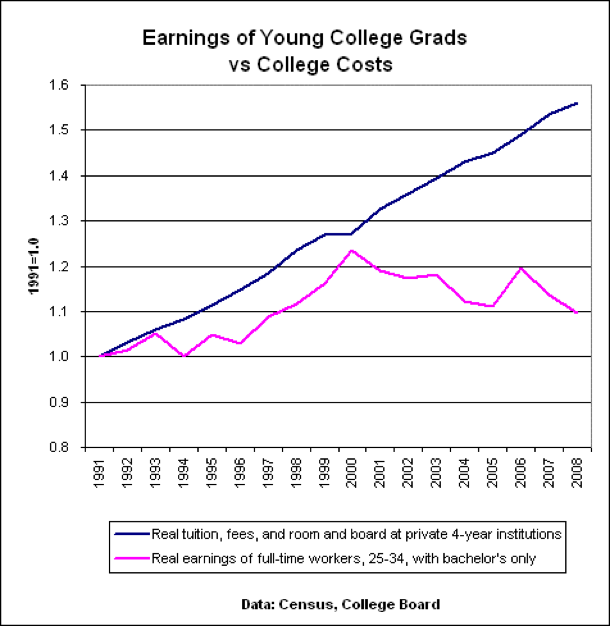

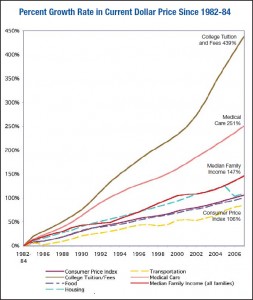

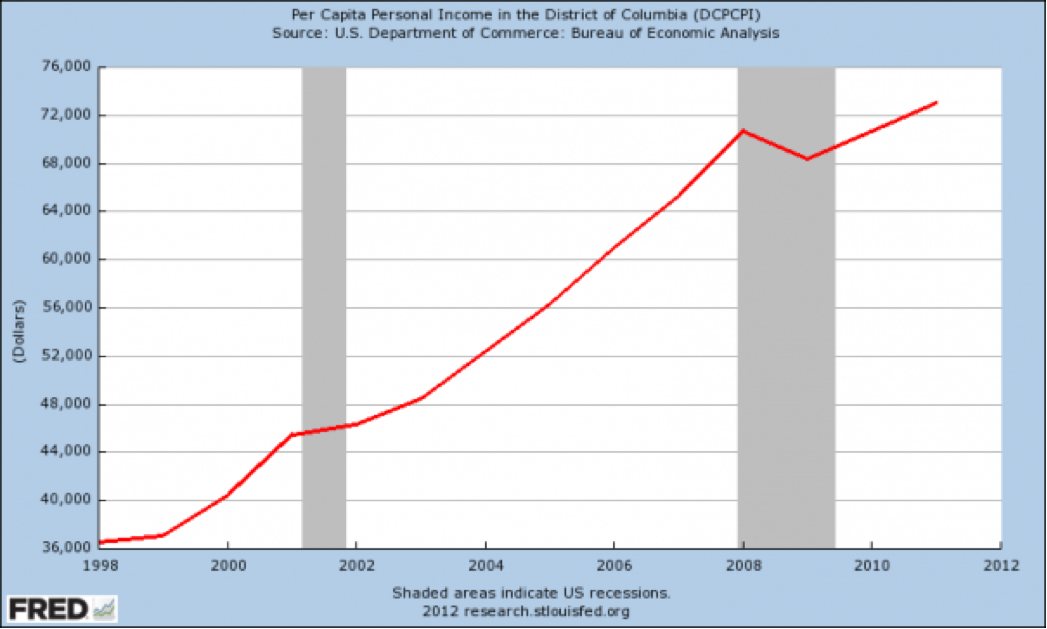

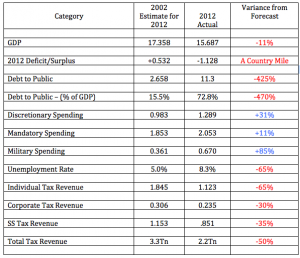

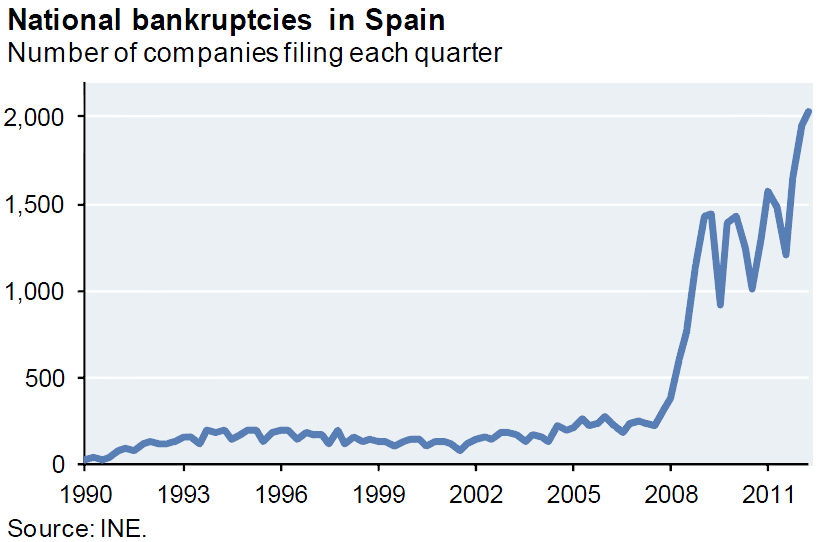

Here's some charts to think about the next time someone, most likely the President of The United States starts yammering about what a fine job he's done in reducing the rate of unemployment.

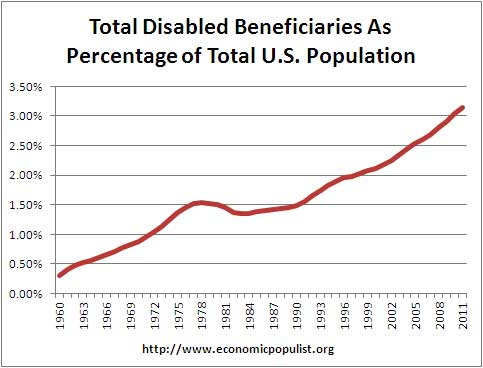

The chart below was taken from an NPR piece titled "Unfit For WorK the startling rise of disability in America". Click anywhere on the chart to pull up their presentation.

Maybe we'll look into U6 next week. I dunno. You could go look into it yourself if you want. Then tell me about it.

- Read more about Unemployment

- Log in or register to post comments

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)