More charts and stuff

On account of us having barely even put a dent in the pile of stuff we've collected recently, here's a little more.

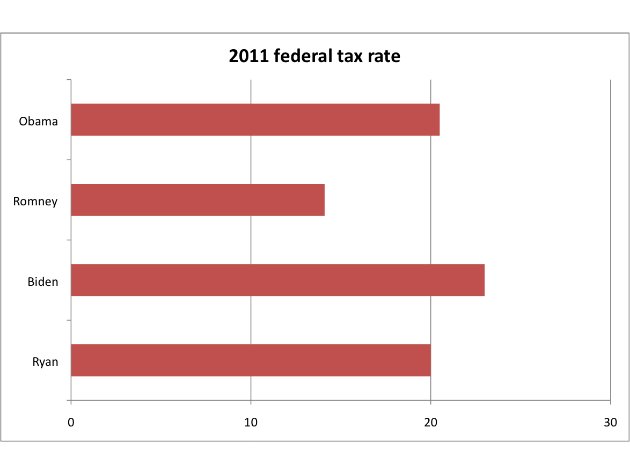

Since it's the morning after the second debate between Barack Obama and Mitt Romney in their contest to determine the next President of the United States, and the subject of "taxing the rich" is bound to have come up, let's start with tax rates.

Romney's 2011 tax rate was significantly lower at about 13.6% than was Obama's at about 21%.

Romney's giving exceeds that of Obama by a score of 29% to 24%.

At the risk of being accused of beating a dead horse, we think everybody should be paying the same rate after a substantial personal deduction and that charitable giving should only be an issue if some selfish little turd who gives next to nothing out of his personal account happens to be running for the office of Vice President.

We know this and are positive that you know it as well, but it is certainly worth repeating.

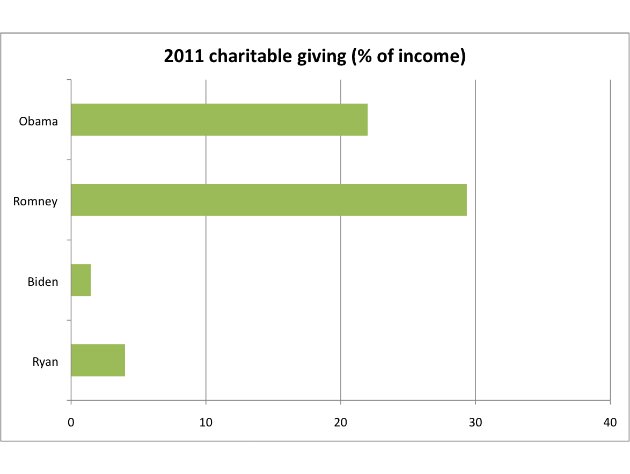

Charts like statistics can be fudged, as is pointed out in these two views of America's 'housing recovery.

We posted these two a while back.

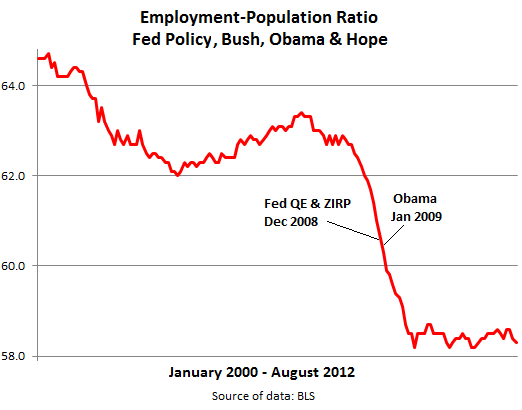

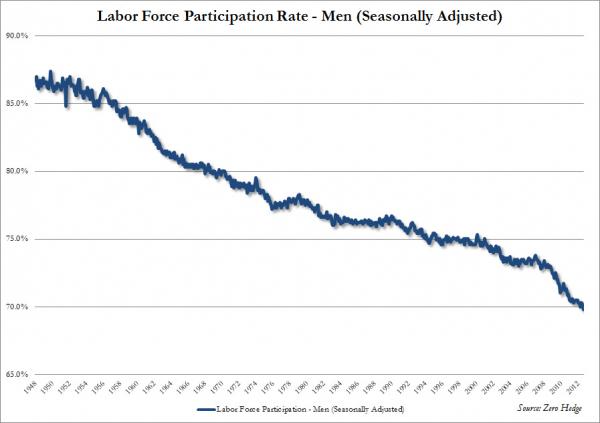

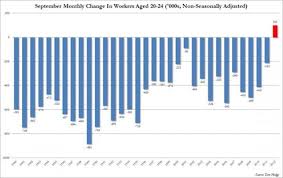

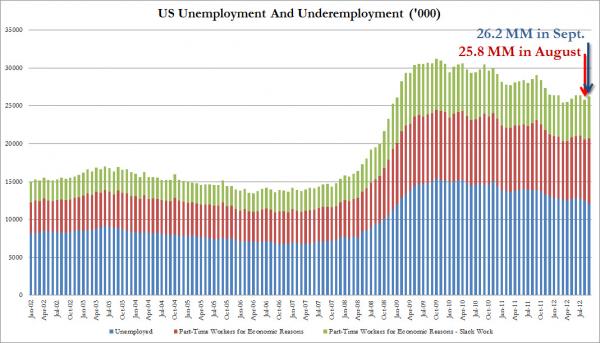

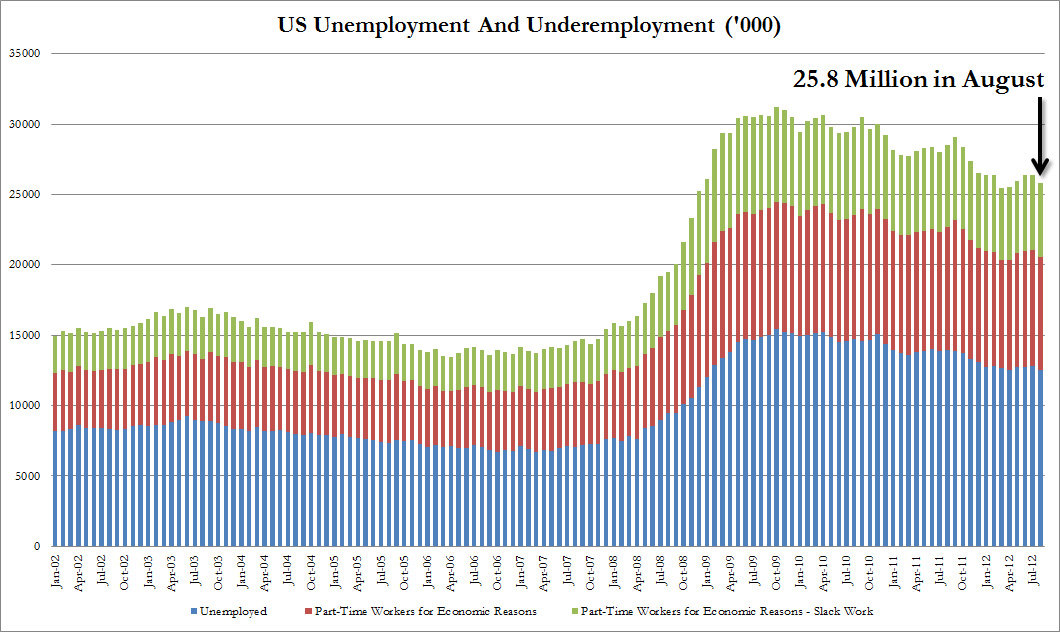

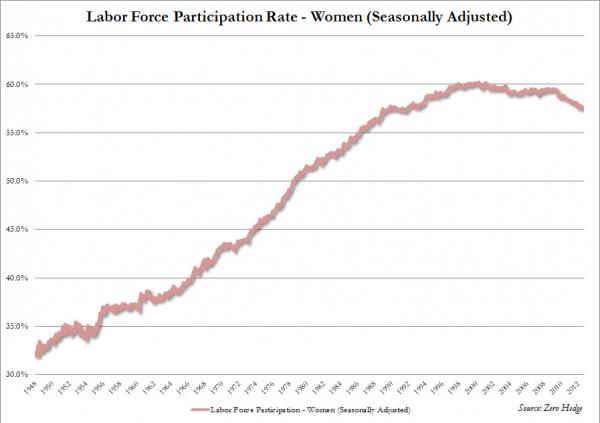

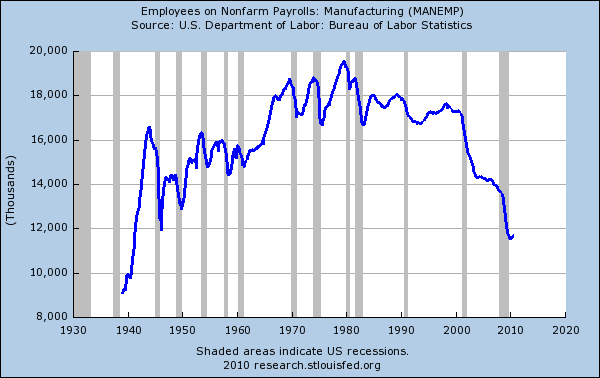

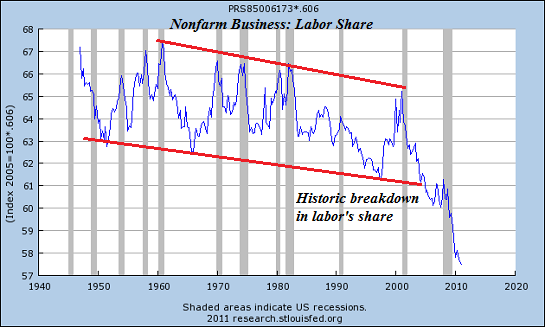

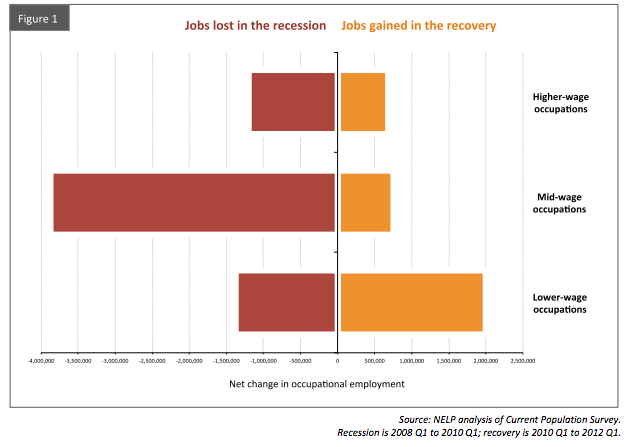

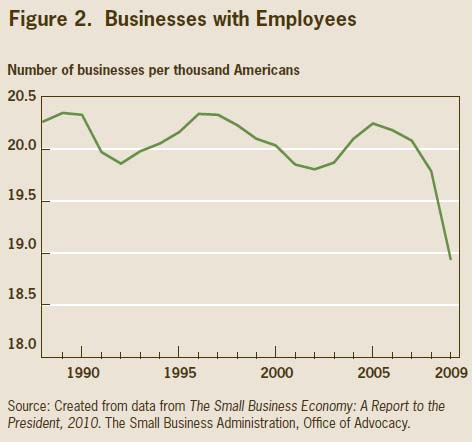

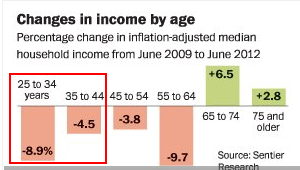

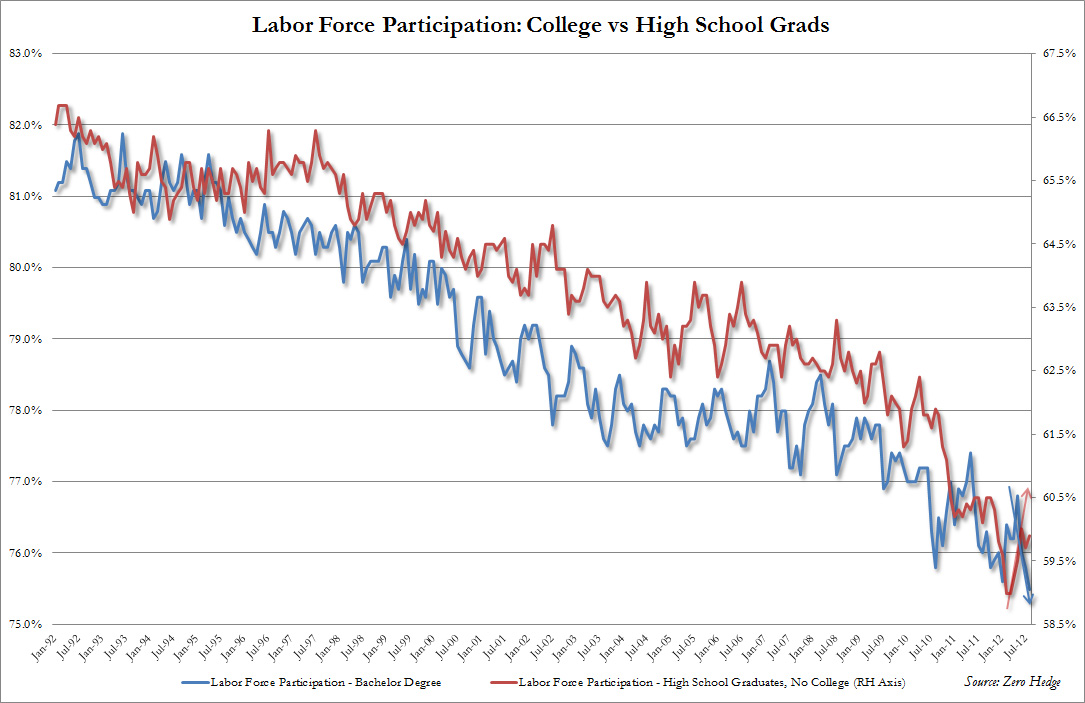

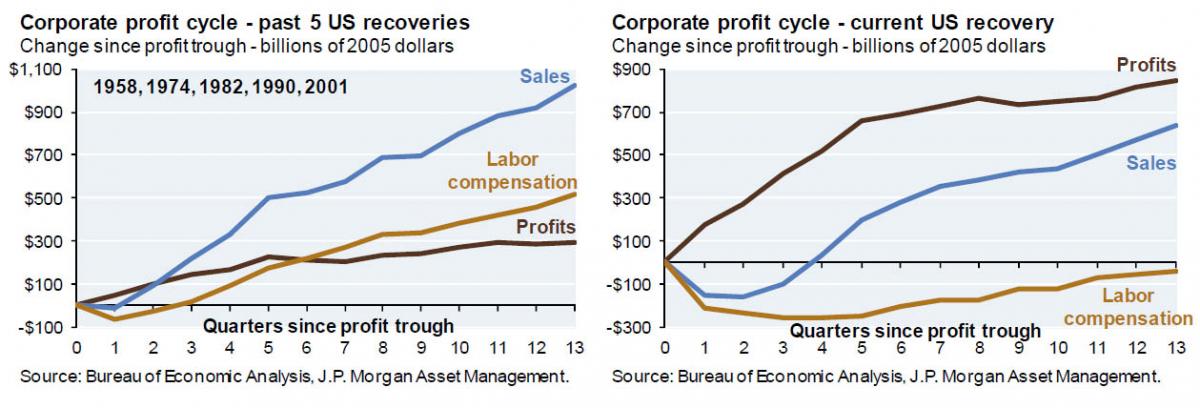

Both employment/population and the labor force participation rate of men are in serious decline.

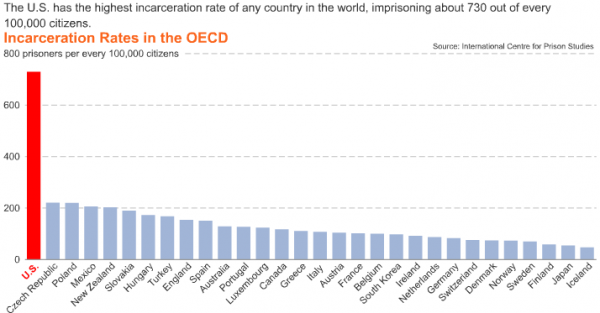

Not to worry though as our government with money provided by the American people supplies many, many, many of our poorest and less fortunate souls with food, clothing and shelter in abundance.

The following depiction accurately ... we think ... conveys how we determine who it is that needs the most help providing for their own living arrangements.

Fair is fair.

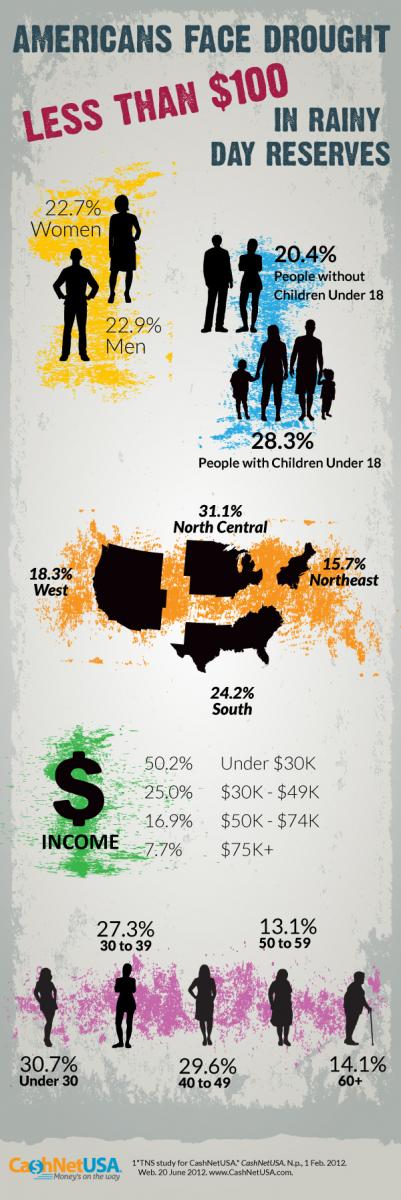

And many Americans need this help as large percentages of the American people have less than a $100 cash reserve for emergencies.

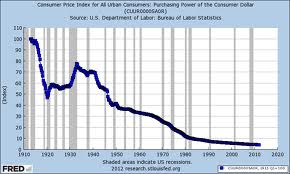

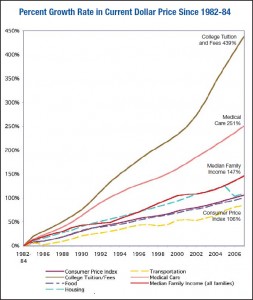

Part of the problem might just be that the value of the unit in which people are getting paid, the dollar, declines in value year after year after year after year after ......

Yeah, yeah you've seen this one before.

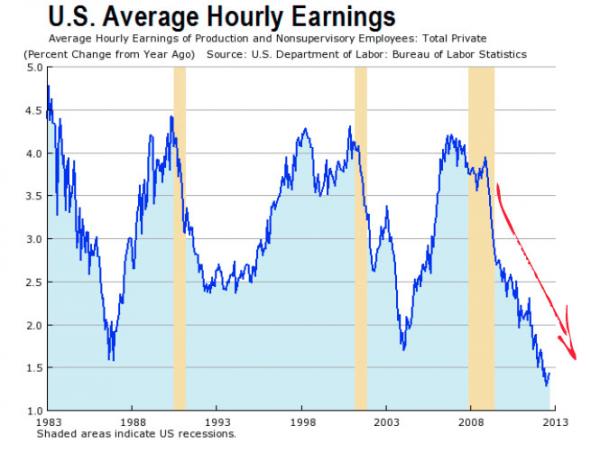

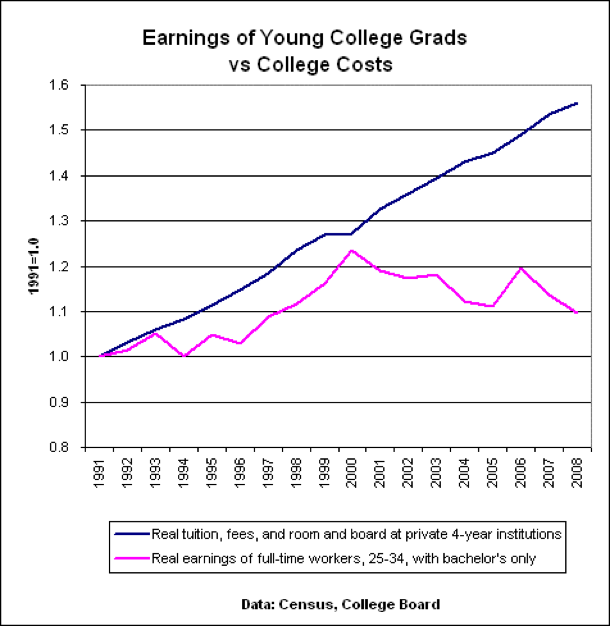

While the rate of change in average hourly earnings is also in decline.

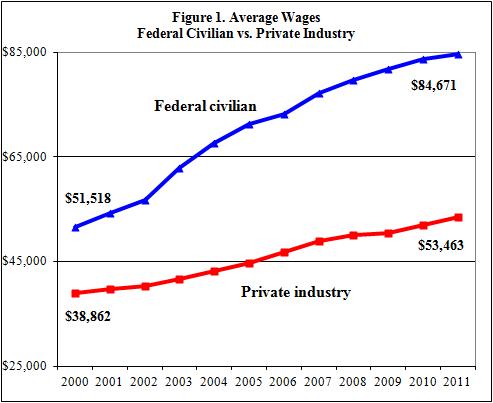

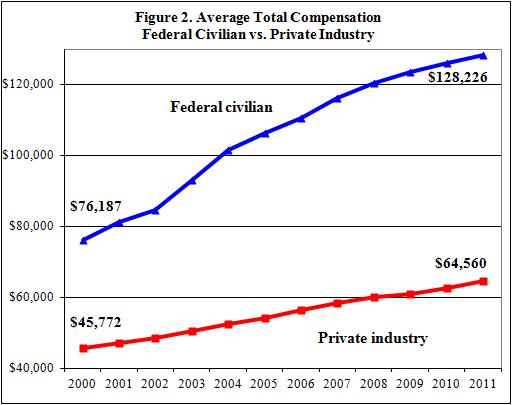

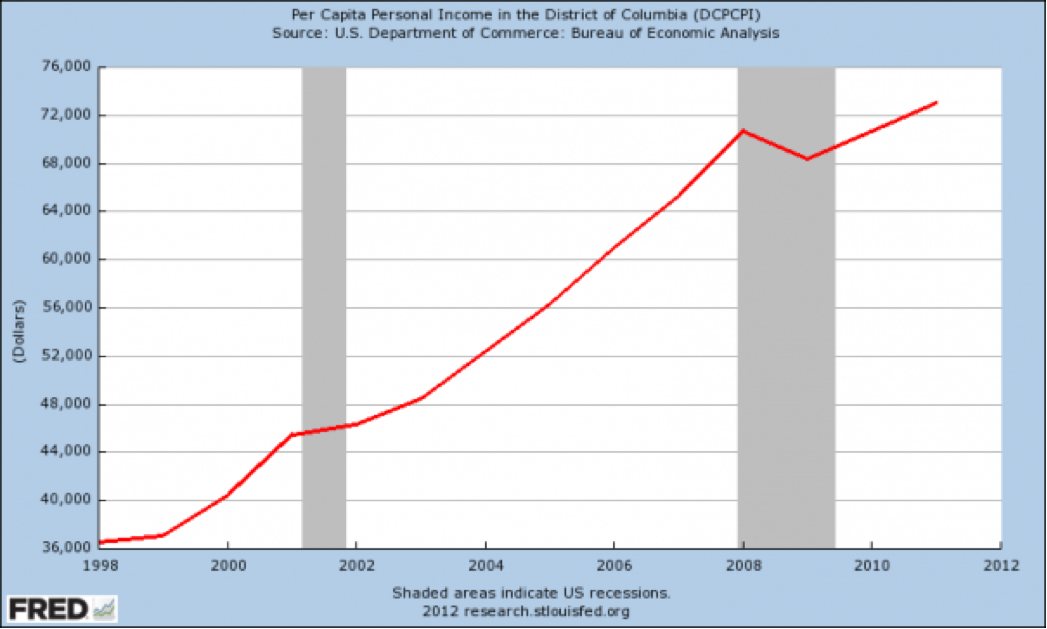

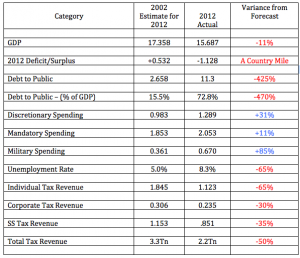

I believe that we have mentioned that those scalawags over there at the government are living large.

We're guessing that not one word of any of this with the exception of that "tax the rich" thing was mentioned last night.

Out of time ..... gotta scoot.

- Read more about More charts and stuff

- Log in or register to post comments

Dave Fishwick wants to start a bank in England.

Dave Fishwick wants to start a bank in England.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)