To quote somebody, but we don't know who.

.gif)

- Read more about To quote somebody, but we don't know who.

- Log in or register to post comments

.gif)

From The Stockholm International Peace Research Institute![]() .

.

As always, click on the graph below for the entire press release which contains links to the paper.

World military expenditure in 2010 is estimated to have been $1630 billion, an increase of 1.3 per cent in real terms.* The region with the largest increase in military spending was South America, with a 5.8 per cent increase, reaching a total of $63.3 billion, according to new data published today by Stockholm International Peace Research Institute (SIPRI)

The United States still exceptional in military spending

Although the rate of increase in US military spending slowed in 2010—to 2.8 per cent compared to an annual average increase of 7.4 per cent between 2001 and 2009, the global increase in 2010 is almost entirely down to the United States, which accounted for $19.6 billion of the $20.6 billion global increase.

‘The USA has increased its military spending by 81 per cent since 2001, and now accounts for 43 per cent of the global total, six times its nearest rival China. At 4.8 per cent of GDP, US military spending in 2010 represents the largest economic burden outside the Middle East’, states Dr Sam Perlo-Freeman, Head of the SIPRI Military Expenditure Project.

Wanna know why some of these countries just flat can't get it together when it comes to creating a democratic society?

Just what the hell is their problem?

Is it culture?

Genetics?

Theology?

What?

The following is the opening paragraph from a paper by Stephen Haber and Victor A. Menaldo titled Rainfall, Human Capital and Democracy.

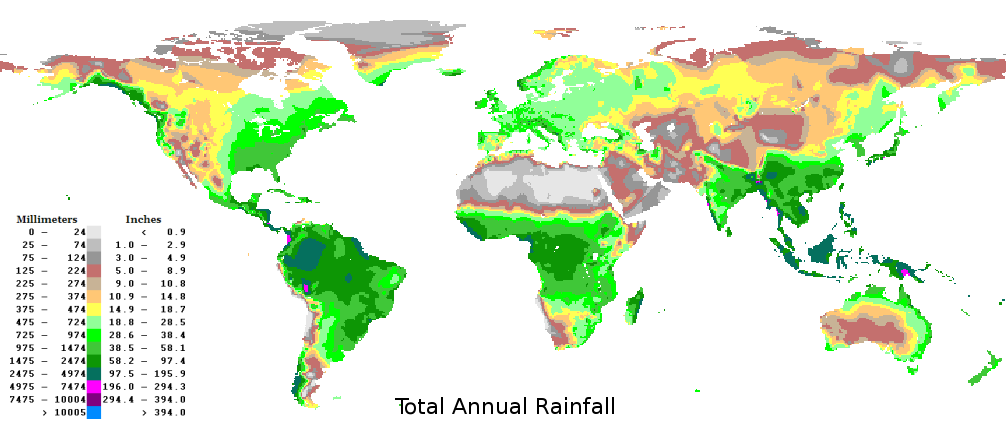

The map comes from World Climate Maps![]() .

.

The entire 59 page paper which by the way I read (I would not lie ..... about reading) can be accessed here![]() .

.

You have to fool around joining up and stuff, but it's free and seemingly spam free.

Why are some societies characterized by enduring democracy while other societies are persistently autocratic?

We show that there is a systematic, non-linear relationship between rainfall levels and regime types in the post-World War II world:

stable democracies overwhelmingly cluster in a band of moderate rainfall (550 to 1300 mm of precipitation per year); persistent autocracies overwhelmingly cluster in deserts and semi-arid environments (0 to 550 mm per year) and in the tropics (above 1300 mm per year).

We also show that rainfall does not work on regime types directly, but does so through the its impact on the level and distribution of human capital. Specifically, crops that are both easily storable and exhibit modest economies of scale in production grow well under moderate amounts of rainfall.

The modal production unit is a family farm that can accumulate surpluses. In such an economy there are incentives to make intergenerational investments in human capital. A high level and broad distribution of human capital makes democratic consolidation more likely.

Here are some excerpts from the paper.

Briefly stated, the world’s liberal democracies are situated in climate zones where the level of rainfall permitted the advent of an agricultural system based on grains and legumes, which are characterized both by a high degree of storability and modest economies of scale in production.

Conversely, high storability and small minimum efficient scales of production do not characterize the crops that can be grown in other climate zones. In deserts, it is not possible to grow anything, except under special circumstances that dramatically raise the scale of production—a subject to which we shall return at some length.

It is, of course, possible to grow food in the tropics—but what can be grown either has very low degrees of storability (e.g. tree crops, such as bananas) or is characterized by extremely large scale economies in production (e.g. sugar cane).

Those specific features of grains and legumes created conditions that favored societies composed of family farmers, as opposed to societies composed of nomadic Bedouins or coerced plantation workers.

High storability and small minimum efficient scales of production generated surpluses that could not be arrogated by political elites bent on political centralization. This structure of agricultural production therefore created incentives for economic specialization, trade, and inter-generational investments in human capital.

Indeed, the first democracies—both in antiquity and in the modern era—were not only located in this band of moderate rainfall, but they emerged out of societies composed of citizens who not only had attained high average levels of education but who were relatively equally matched in terms of their educational endowment and sophistication.

Colonial New England is, of course, the archetype: a society of highly literate, family farmers.

What was true about New England was also true, however, about Ancient Athens, 17th Century Holland, 18th Century England, and 19th Century Canada.

Here's maybe a better example on how government and the "Political Class" keeps America divided.

Let's say somebody earned $100,000 last year.

How much taxes did he/she pay?

Who the hell knows?

Everybody is different.

Do you have a mortgage?

Live in a high tax environment?

Breed excessively?

Drive far to work?

Save for retirement?

Support a church or a charitable organization?

There is only one area where everybody is the same.

Everybody is pretty damn sure everybody else is paying a helluva lot less.

Let's take your Uncle Roany as an example.

I own my home free and clear, having bought a much smaller, cheaper house than I could have, had I been willing to mortgage.

So ....... here's my question?

Why the hell should I be expected to subsidize the interest payments you make on your purchase of a bigger and nicer house than I have??????

Your Uncle Roany really likes sex.

Really, really ............................................ Seriously.

Early on in my marriage, I didn't realize that a lot of sex would result in a lot of babies.

I thought it was the fluoride causing it.

Why should you be asked to subsidize the consequences of my baser instincts and lack of training in the "Facts of Life"?

Because I have a pretty small house in a suburban bedroom community, my property taxes are pretty low.

Why should I have to subsidize your lifestyle in a real cool, high tax city.

I like to give money away.

Why should you be expected to subsidize my religious, charitable or civic convictions?

How do you think people would feel about themselves, their neighbors, and their country, if everybody knew for damn sure that everybody was getting the exact same deal?

Whatever that exact sameness might be?

First of all, apologies to whomever put together the below chart.

I grabbed it off from somewhere thinking that there was some identification on the chart to acknowledge and link to.

There is not.

Now I can't remember where I found it.

If somebody has seen it before, let me know.

I will cheerfully give credit and link to the source.

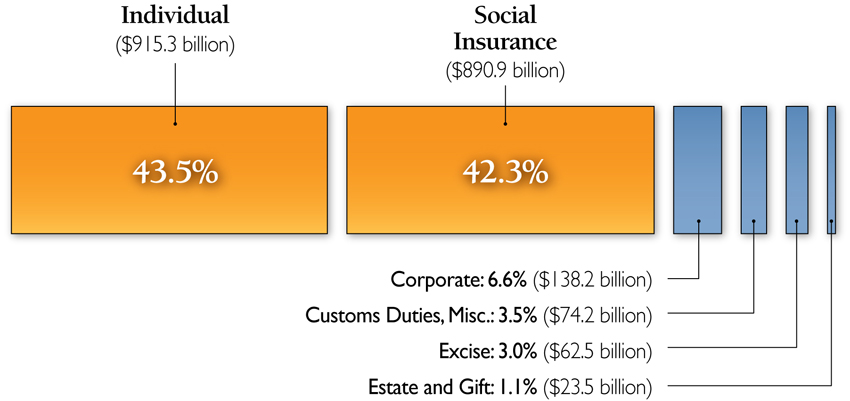

The following chart provides an outstanding example of how our government keeps us apart and at each other's throats.

Anybody paying the slightest bit of attention has heard that the rich pay the lion's share of the INCOME TAXES in this country.

It is true.

The top 1% of taxpayers pay about 35% of our nations INCOME TAX.

The top 25% pays about 83%.

The top 50% pays about 96%.

It is also true, the rich earn the lion's share of our national income, but on a percentage basis they pay more in taxes than they earn in income.

But INCOME TAXES on individuals only makes up 43.5% of the total tax receipts of the federal government.

42.3% is paid in in the form of "PAYROLL TAXES" aka "WITHHOLDING TAXES" aka FICA, aka Social Security and Medicare taxes which are deducted directly from wage earners paychecks and are sent to the government.

The balance mostly comes from by corporate taxes which we all pay when using the goods or services provided by corporations, and some other relatively minor sources.

The withholding rate for "The Old Age and Survivors Insurance Trust Fund (OASI), again what most of us call Social Security or FICA is 12.4% of one's taxable income.

The rate for Medicare is 2.9% of one's taxable income.

For a total of 15.3% tax on wage earners above the INCOME TAX.

In the case of Social Security, the tax is largely paid by middle and lower income taxpayers because the income against which it is applied is capped at $106,800.

Here's where the truth gets bent.

I'm trying to put the best construction on this.

You are told that the funds go to the "Social Security Trust Fund" or the "Medicare Trust Fund".

And that's true as far as it goes, but what really happens is that the Federal Government issues debt (bonds) which is exchanged for your (cash) payroll taxes.

And subsequently sends your payroll taxes (cash) to the general fund.

Every dime of income the Government collects regardless of source, ends up in the general fund where it is spent as though it were exactly the same thing as "INCOME TAXES".

Name an activity that the Federal Government participates in, and that is where your FICA is being spent.

Wars in Afghanistan, Iraq, now Libya, maybe Iran.

Defending Europe (NATO) from Russia, or Japan, Australia, New Zealand and Taiwan and South Korea from North Korea and China, the Saudis from Iran.

Not to mention from their own people.

Welfare benefits, unemployment compensation, food stamps.

Government salaries, pensions, benefits and perks.

National parks, roads, bridges, education, research.

Office supplies.

Now, some of that stuff you can legitimately call an investment in America.

But is it appropriate to be investing people's health and retirement monies on all of the above?

Here's the government's argument,

"Some people are not able, or prepared to invest their retirement money themselves. What if they make bad investment decisions and lose their money?

Were some people in control of their retirement funds they would indeed make some bad investments and suffer losses.

But just for fun, imagine a prospectus selling an investment in the defense of Europe.

Here's the offering.

You provide military equipment and personel to Europe free of charge, and in so doing allow the average European citizen a month of vacation every year, mostly free health care, and retirement at around age 58.

You don't get a plug nickel back, get to work until your 61.5 at least, but ................. you get to say that you're making the world safe for Democracy.

You can be a drooling moron and you're still passing on that opportunity.

So, here's the consequences:

Upper income people feel abused because they're thinking they're doing all the heavy lifting.

The middle class feels abused because they thought they were saving for their retirement, but are starting to realize that Social Security is likely to go broke, their money having been squandered.

In truth, it ain't gonna go broke.

The government will print the dollars to pay you back.

The bad news is that each dollar is likely to be worth a helluva lot less than the one you payed in.

Retirement money is just being spent and not invested, which results in the poor feeling abused because there are no jobs, and subsequently no future.

While all they hear is "The Rich" bitching about their taxes.

Thanks to everyone who sent this story through, especially to Don D. who had the source, ![]() Trim Tabs Investment Research, which impressed us around here to no end.

Trim Tabs Investment Research, which impressed us around here to no end.

As always, click on the photo.

Welfare State: Handouts Make Up One-Third of U.S. Wages

By: John Melloy Executive Producer, Fast Money

Government payouts—including Social Security,Medicare and unemployment insurance—make up more than a third of total wages and salaries of the U.S. population, a record figure that will only increase if action isn’t taken before the majority of Baby Boomers enter retirement.

So anyway, the above story reminded me about a Joni Mitchell interview Mary? had sent in a while back that I had been unable to find a place for.

It takes a couple minutes to get to the tie in, but she tells a good story, is still pretty easy to look at, and has a surprising take on the condition of American society.

Hang in there for it.

As an aside, Charlie Rose![]() consistently does outstanding interviews with people from everywhere.

consistently does outstanding interviews with people from everywhere.