Reading at 3:15 Thursday Morning

![]() Stratfor Global Intelligence is in my opinion among the better international news sites.

Stratfor Global Intelligence is in my opinion among the better international news sites.

At about $30 a month, it's probably not worth it to most folks.

They have a one week trial deal.

I like it.

From an article titled,

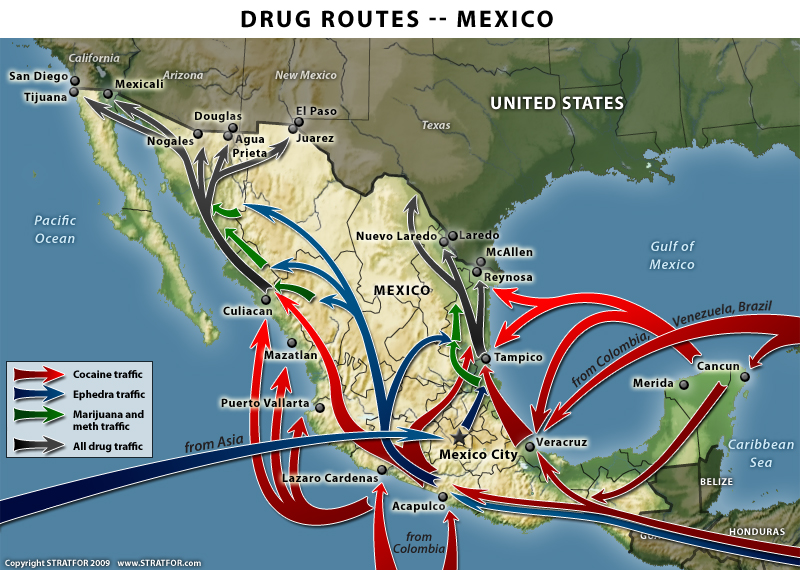

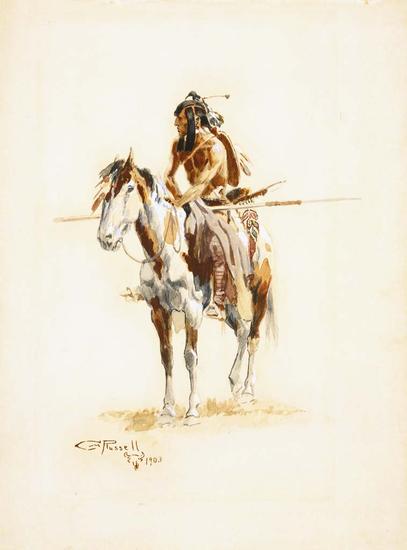

"Mexico a Struggle for Balance"![]()

“…Mexico was nearing the status of a failed state.

In revisiting this issue, it seems to us that the Mexican government has lost control of the northern tier of Mexico to drug-smuggling organizations, which have significantly greater power in that region than government forces.

“…The

Narcotics derive from low-cost agricultural products that become consumable with minimal processing.

With its long, shared border with the

This means extraordinary profits can be made by moving narcotics from the Mexican side of the border to markets on the other side…

The result is ongoing warfare between competing organizations…

“Indeed, what the wars are being fought over in some ways benefits

The amount of money pouring into

From

- Read more about Reading at 3:15 Thursday Morning

- Log in or register to post comments

.jpg)

.jpg)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)